We can assist you to assess any VAT refunds and can compile and submit these claims to Customs.

- If your business is UK based and you have overpaid UK VAT

- If your business is based outside of the UK and you are not registered for VAT in the UK. In this case, your business may be entitled to a VAT refund on expenses incurred in the UK such as hotels, meals (not entertaining) and car hire.

- If you are a UK business and you travel to another European Union member country on business. In this case, you may be entitled to recover VAT on some of your expenditure. Each European country has different rules about which expenses are recoverable and the rules can be complex.

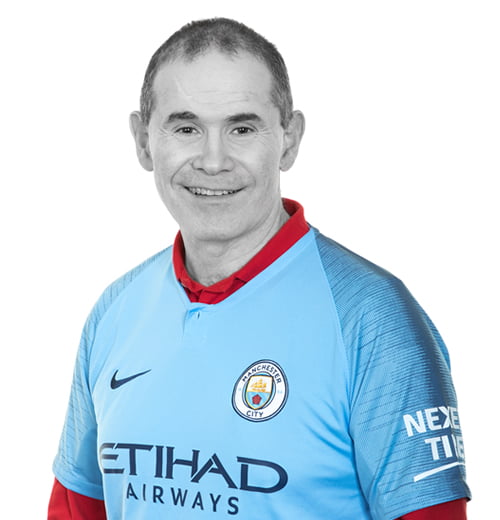

| For further information, please contact Darren Specterman on 020 8458 7427 or click on his name to send an email. |