1. Q: What is self-assessment?

A: Self-assessment is a tax system whereby taxpayers are responsible for paying the correct amount of tax on set dates, without waiting for HM Revenue & Customs to demand this.

2. Q: Who does it apply to?

A: Everyone who has to fill in a tax return (people in business and those who have untaxed income e.g. property income, and also higher-rate taxpayers).

3. Q: When did self-assessment start?

A: The first tax year for self-assessment was 1996/97, which commenced on 6 April 1996.

4. Q: When do I pay my tax?

A: Payments are normally made in two instalments on 31 January and 31 July each year (except for PAYE and other tax deducted at source). Any balance due is settled the following 31 January.

5. Q: What happens if I pay my tax late?

A: Interest will run from the date the tax is due. There is also a 5% surcharge if any part of the tax for the year is unpaid by 28 February after the end of the tax year, and there will also be a further 5% surcharge on any amounts still unpaid five months later, at the end of July.

6. Q: Does self-assessment mean that I have to prepare my own tax return?

A: No. Glazers prepares tax returns on behalf of clients. We will be pleased to hear from you if we can be of help.

7. Q: How much time do I have to send in my tax return?

A: If you submit a paper return, you need to submit the completed return by 31 October following the end of the tax year. For electronically-submitted returns, you have until 31 January following the end of the tax year in order to submit the return. Glazers will normally submit your return electronically. Therefore, the effective deadline for clients for whom we complete tax returns is 31 January.

8. Q: What happens if my tax return is sent in late?

A: There is an automatic penalty of £100 plus a further £100 if the return is more than six months late, with the proviso that the penalty cannot be more than the tax due.

9. Q: Does self-assessment mean that the Revenue do not assess my tax?

A: The Revenue will only raise assessments in rare cases, for example if there is an undue delay in submitting your tax return. They will continue to raise assessments where appropriate for settling your tax affairs for any years prior to self-assessment, but generally, tax assessments are a thing of the past. You will, however, receive statements of account from the Revenue.

10. Q: How do the Revenue check that my tax return is right?

A: The Revenue may ask questions if they suspect that something is wrong. They also select some returns at random for checking even where everything appears to be in order. The Revenue have twelve months from the normal filing date to notify you if they intend to make enquiries.

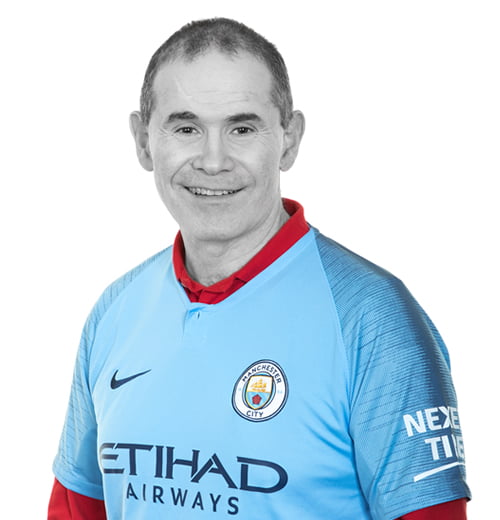

Glazers can insure you against the professional fees arising from a tax enquiry. For details contact Darren Specterman.

11. Q: How do I prove that I have reported the correct figures if the Revenue query my return?

A: It is obligatory under self assessment rules to keep documentary evidence supporting all the figures making up your tax return.

12. Q: How long do I need to keep my tax records?

A: Records relating to property income or any self employed income must be kept until at least the 5th anniversary of the filing date for the tax return. Income relating to employments and investment income must be kept for at least one year after the normal filing date. As a general rule, we would advise clients to retain all their tax and business papers for at least six years from the end of the tax year to which they relate.

13. Q: What happens if I don’t keep my tax records?

A: If you do not keep your records for the required period, the Revenue may charge a penalty for each tax year concerned.

14. Q: If I am employed, how can I be sure of getting the necessary details from my employer to complete my tax return?

A: Your employer has a statutory obligation to provide you with the necessary information. There are also deadlines for providing you with this information, so that you will have it in time to complete your tax return.

15. Q: If I am self-employed, do I have to make up my accounts to 5th April every year, to coincide with the rest of the tax return information?

A: This is not obligatory, but the new system makes it tax efficient in most cases to prepare accounts to 31st March or 5th April each year. This may depend on individual circumstances and we will be pleased to discuss this with you.

16. Q: If I am an employer, do I have any particular responsibilities under self-assessment?

A: Employees must be provided with form P60 by 31st May following the end of the tax year, and they must also be provided with a copy of form P11D (where relevant) by 6th July following the end of the tax year.

17. Q: Are there any special rules for partnerships?

A: Yes. Each partner in a partnership is assessed individually on his or her share of the profit. The partnership needs to complete a partnership tax return and each partner is individually responsible for the tax on their share of the profits.

18. Q: What should I do if my tax affairs are not currently up to date?

A: Get in touch with us to arrange a meeting, so that we can advise you of the information we need to bring everything up to date on your behalf.

19. Q: Who should I contact if I have any other questions about self-assessment?

A: Contact our Tax Partner Darren Specterman who will be pleased to give you swift and expert guidance.

For solid advice, please contact our tax partner Darren Specterman on 020 8458 7427 or email darren.specterman@glazers.co.uk.