VAT is one of the most complex and onerous tax regimes imposed on business – so complex that many businesses inadvertently overpay or underpay VAT.

The ever-widening scope of VAT, the constant stream of detailed changes to the regulations, and the ever-growing demands of HM Revenue & Customs call for a trained professional eye to ensure that you do not fall foul of the regulations, and do not pay the Exchequer more than you need to.

We provide an efficient cost effective VAT service, which includes:

- Assistance with VAT registration

- Advice on VAT planning and administration

- Use of the most appropriate VAT scheme

- Preparation and submission of VAT returns

- Planning to minimise future problems with HM Revenue & Customs

- VAT healthcheck reports

- Negotiating with HM Revenue & Customs in disputes and representing you at VAT tribunals

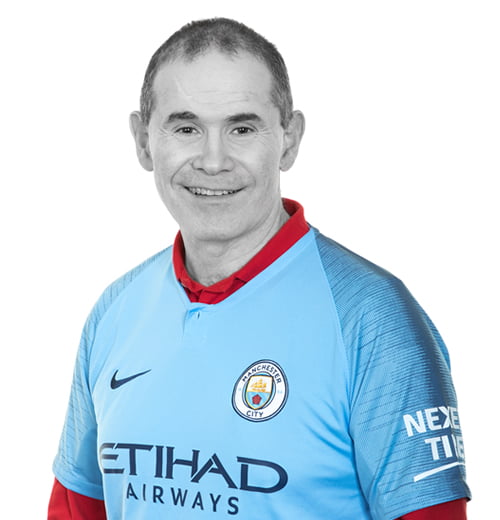

| For more about VAT consultancy, please click here. For further information please contact either of our partners Darren Specterman or Rita Wader on 020 8458 7427 or click on either of their names to send an email. |